For loans approved starting the week of April 6 2021. This makes it an attractive option for small businesses to have access to additional liquidity and reduce the cash flow burden as they begin to rebuild their business.

Sba Economic Injury Disaster Loan Process Loudoun County Economic Development Va

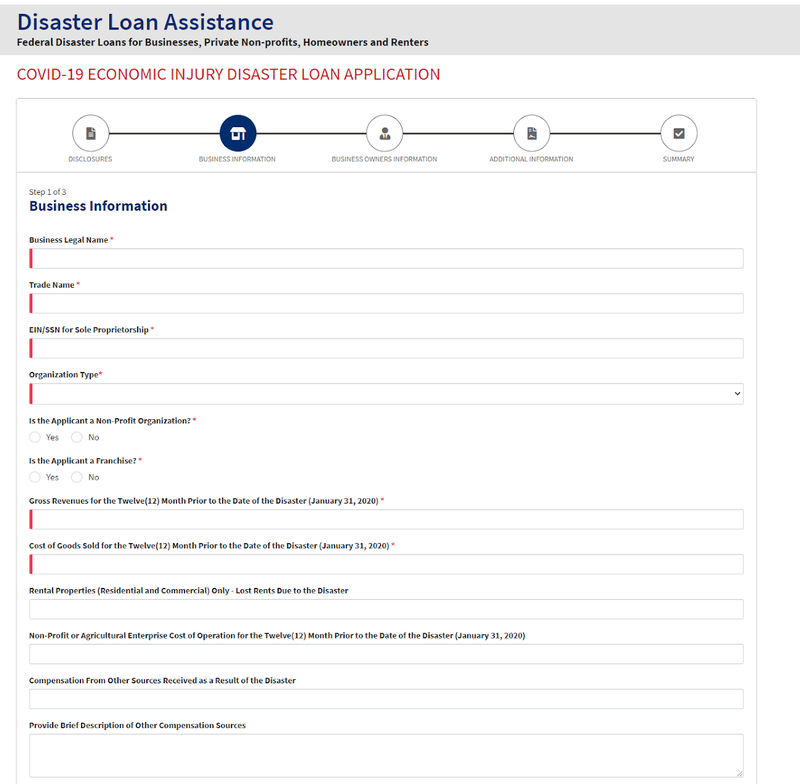

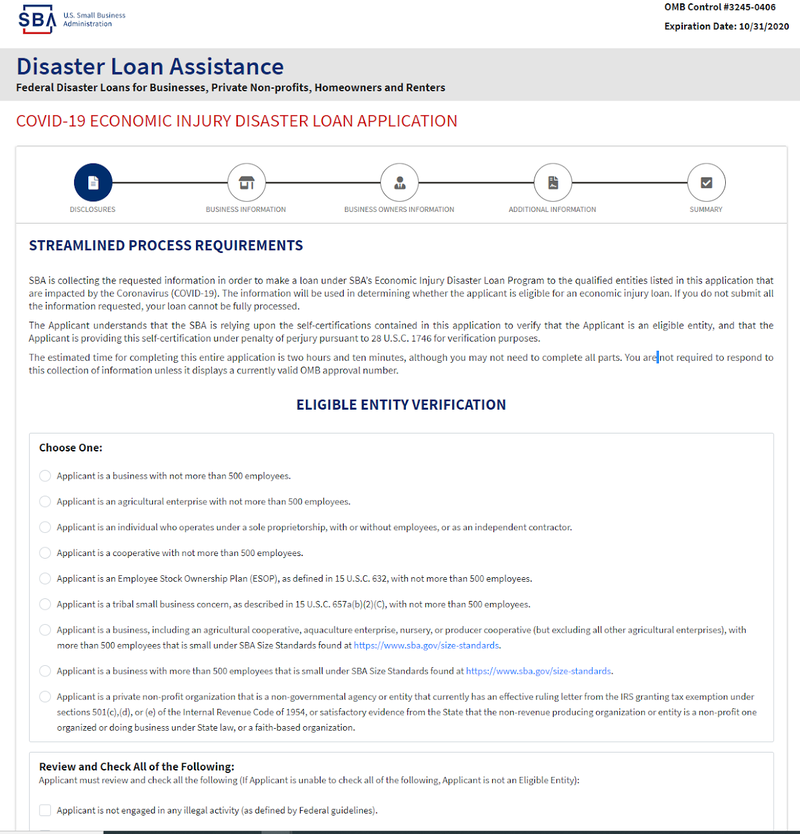

EIDL Part of Small Business Administration Disaster Loans Program The Small Business Administration SBA operates a general disaster loan program for business owners who have suffered significant economic losses due to a natural disaster terrorist attack public health emergency or other situation outside of their control.

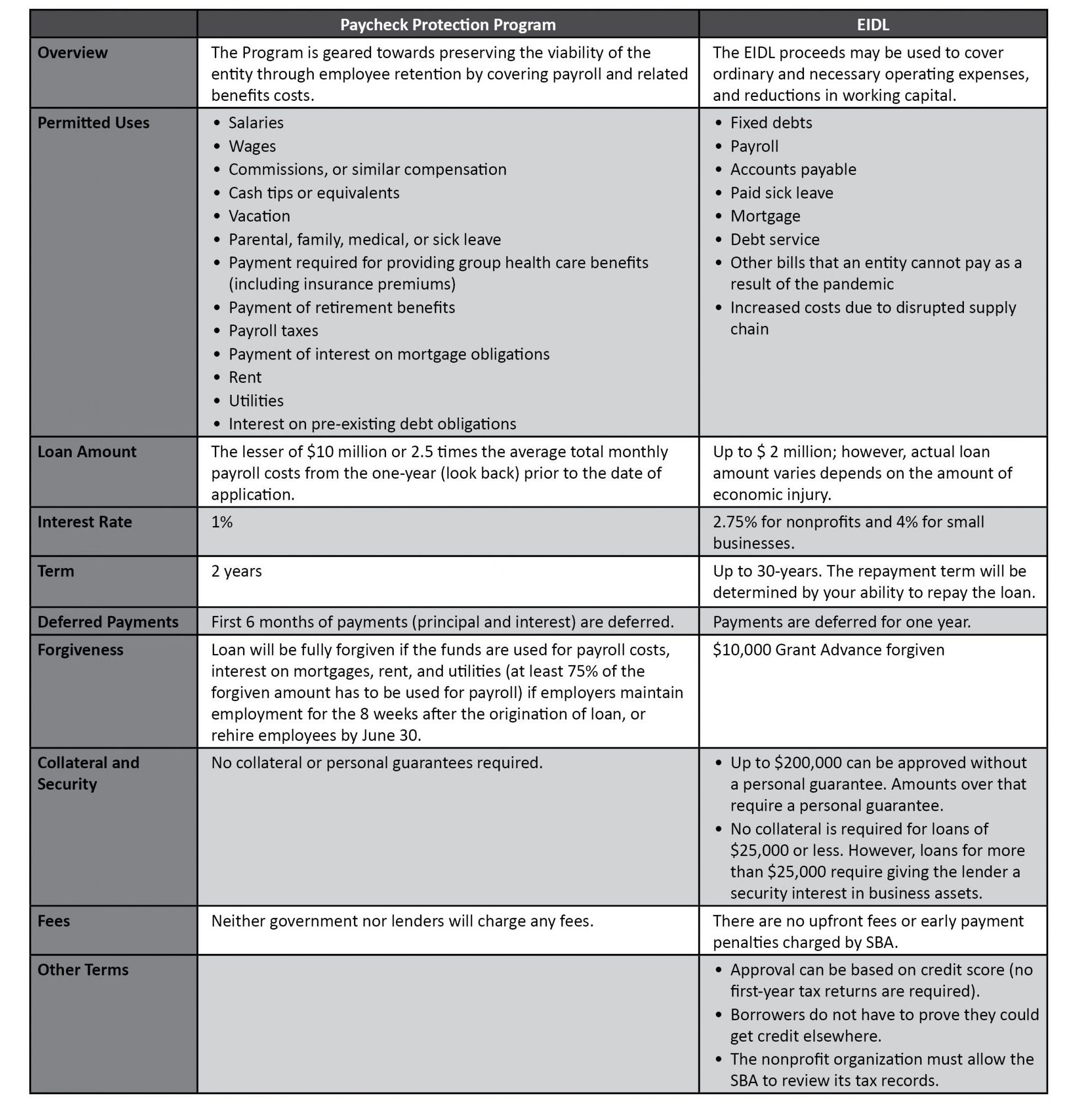

Eidl loan terms. Small businesses and nonprofits the US. To meet financial obligations and operating expenses that could have been met had the disaster not occurred. The EIDL loan program authorizes each borrower to qualify for a loan up to 2000000 as determined by the SBA.

24-months of economic injury with a maximum loan amount of 500000. What are the Economic Injury Disaster Loan terms. Here are the current interest rates for SBA loans in July 2021.

Most EIDL loans have 30-year terms interest rates below 4 and payments deferred for up to two years although interest is accruing and business owners should be aware of that fact. Approximately 296 361. The repayment term will be determined by your ability to repay the loan.

Working capital loans are available to assist small business concerns. Not the EIDL advance is no longer available to new applicants. The EIDL is a low-interest long-term loan for small business owners that have been impacted by COVID.

There are no upfront fees or early payment penalties charged by SBA. 375 for for-profit businesses and 275 for nonprofit businesses. First the amount that you qualify for should be approximately six times the expenses of your business in a normal month.

30-year terms Interest rates. In order to meet their ordinary and necessary financial obligations that cannot be met as a direct result of the disaster. For loans approved prior to the week of April 6 2021 see.

12 months from the date of the promissory note For loans less than 25000. EIDL terms Unlike PPP loans disaster loans which carry a term of 30 years and a 375 interest rate require a personal guarantee and are backed by collateral for loans exceeding 25000. To further meet the needs of US.

What are the loan terms for Economic Injury Disaster Loans. The advance portion of the loan will bebased on the number of employees in your business and will be 1000 per employee up to 10 employees or 10000. The EIDL interest rate is currently 375 for small businesses and 275 for nonprofits.

Economic Injury Disaster Loans EIDL. COVID-19 EIDL loans are offered at very affordable terms with a 375 interest rate for small businesses and 275 interest rate for nonprofit organizations a 30-year maturity. These loans are intended to.

The SBA does NOT take a security interest in any collateral. To find out more on qualifications terms and loan repayment on EIDL refer to SBA EIDL LOAN TERMS For EIDL a personal credit check for all applicants plus a business credit check for all applicants except sole proprietors for loan amounts above 200000. For loans greater than 25000.

These loans offer low fixed rates and repayment terms up to 30 years. Interest continues to accrue during the deferment period and borrowers may make full or partial payments if. EIDL terms are substantially better than one might expect on an acquisition loan from the SBA.

The SBA informed us on June 24th that only around 30000 EIDL loan increases had been approved thats over about 10 weeks of the program being lived. Since the EIDL loan increase program got underway in April 2021 the EIDL loan increase progress has been slow. That loan is a 30 year loan at 375 interest with no payments for the first year.

The 2 million loan cap includes both physical disaster loans and EIDLs. It should be covering six months of expenses. Current rates for SBA 7a loans.

Loans are for a term of 30 years All EIDL loans carry a term of 30 years with an interest rate of 375. Repayment terms on the loans are over a 30-year term at 375. FAQ regarding COVID-19 EIDL.

The SBA takes a general security interest in any and all. To keep monthly payments low the SBA offers long-term repayment plans to eligible borrowersup to 30 years. Current rates for EIDL loans for COVID relief.

Current rates for SBA CDC504 loans. Businesses with fewer than 500 employees certain nonprofits and agricultural businesses can apply and be approved if they meet all criteria set by the SBA. Loans are automatically placed into deferment the first year of the loan with repayment.

375 for small businesses. As part of the EIDL an advance of up to 10000 is available for those who apply for the EIDL. The SBA can provide up to 2 million in disaster assistance to a business.

Summary of EIDL loan terms. Small Business Administration reopened the economic injury disaster loan. EIDL Loan Increases Face Internal SBA Challenges.

What Government Loan Program Should You Apply For

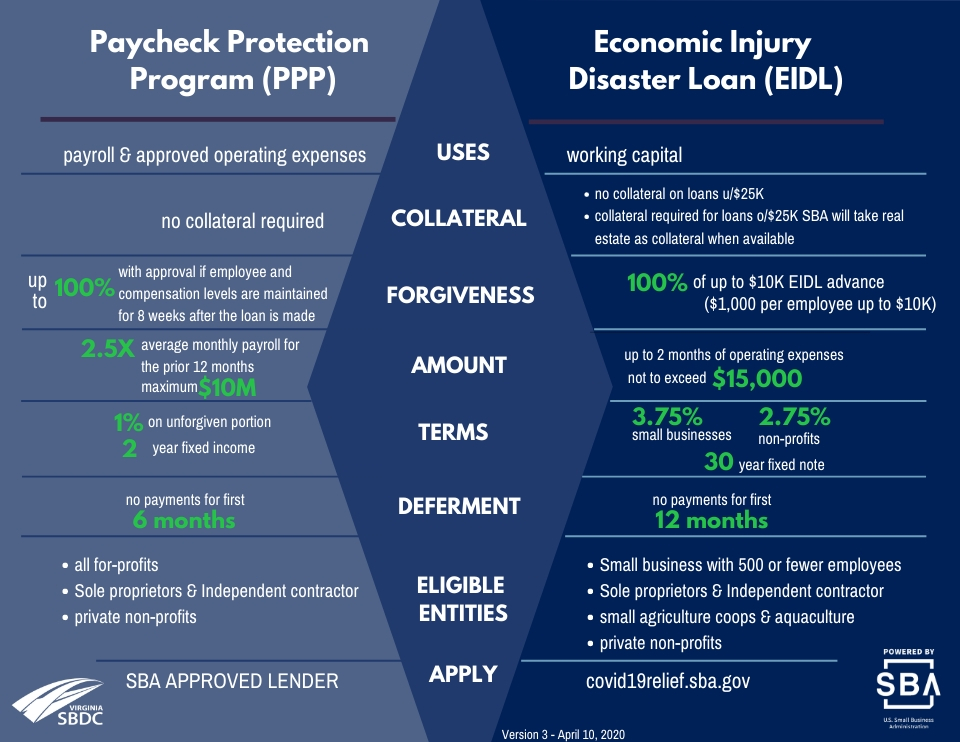

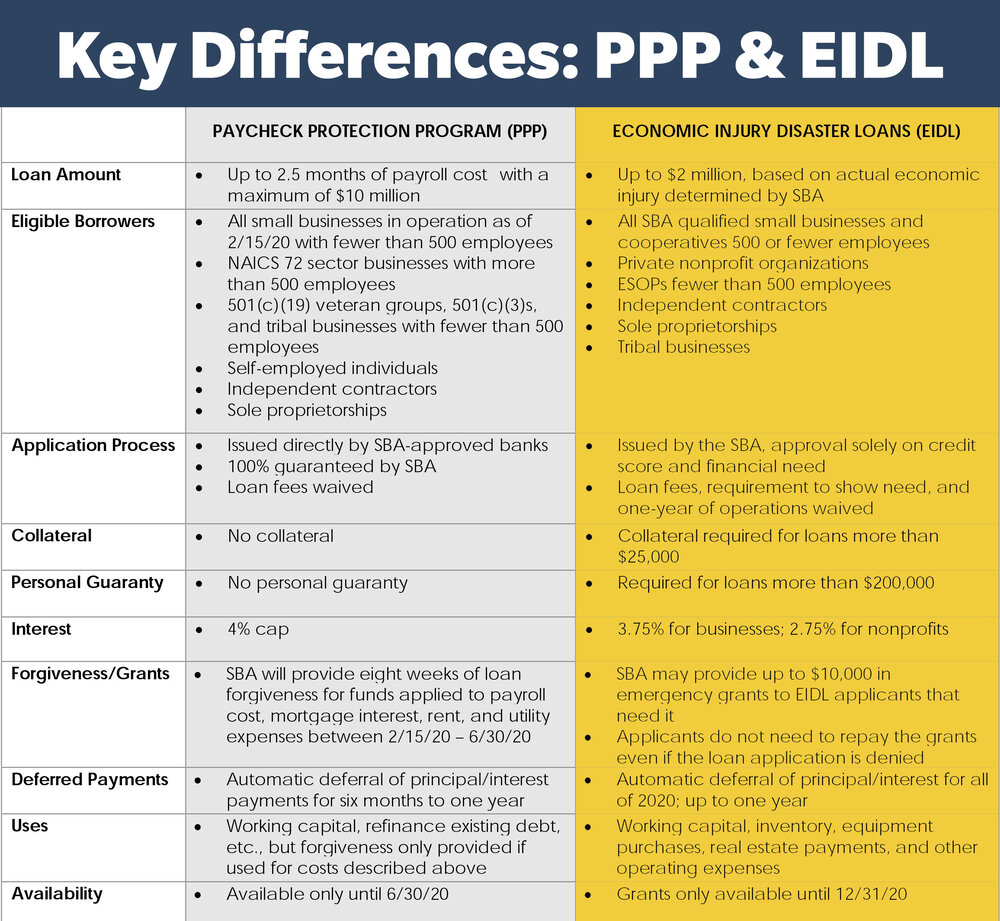

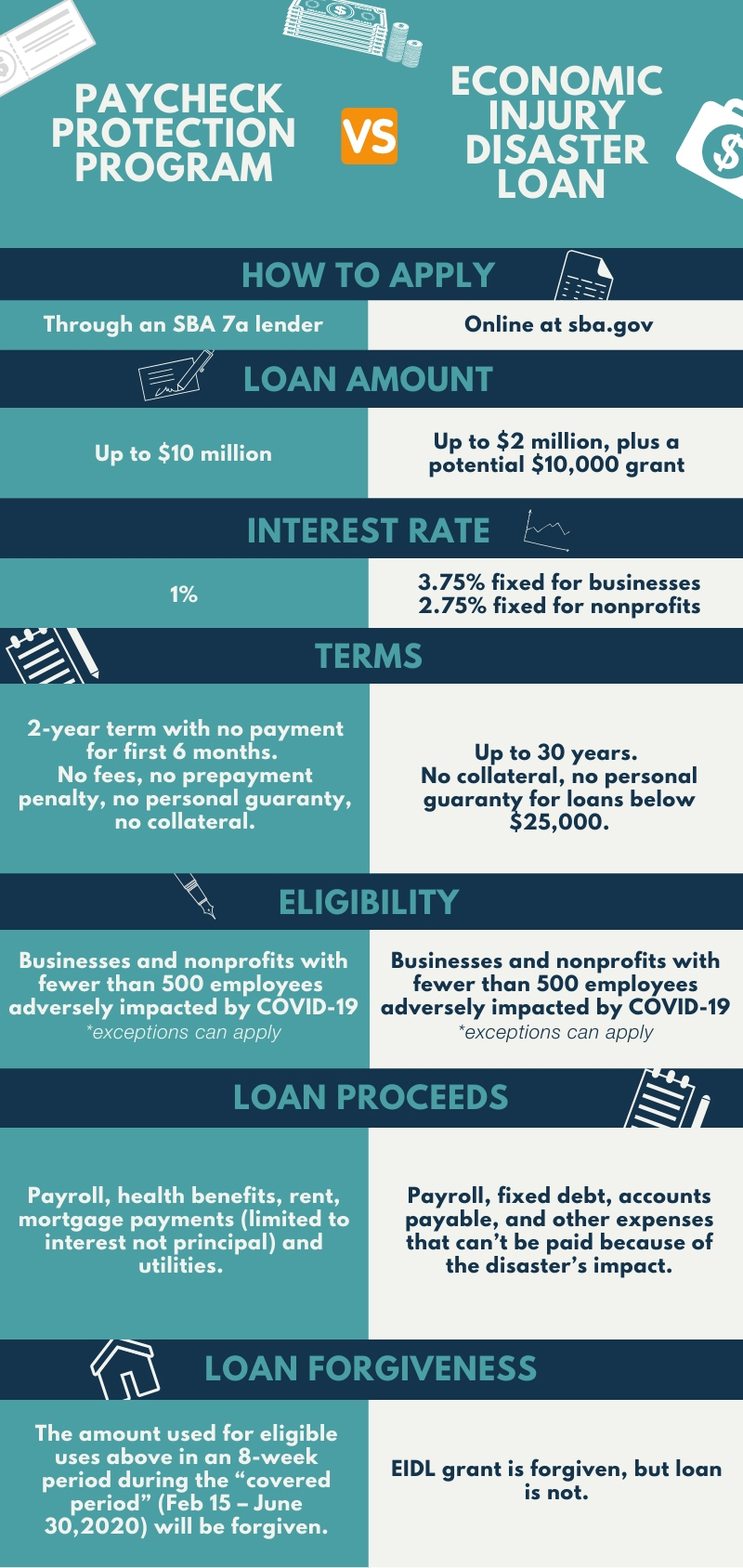

Ppp Vs Eidl What Funding Is The Best Fit Alamance Strong

Read And Review An Eidl Loan Document Before Accepting It Faqs Covid Loan Tracker

Ppp Eidl And Mslp Loans A Do S And Don Ts Chart

The Economic Injury Disaster Loan Vs The Paycheck Protection Program Wiss Company Llp

Eidl Loan Terms Personal Guarantee

Sba Economic Injury Disaster Loan Faq Small Business Development Center

Should I Accept My Sba Economic Injury Disaster Loan Offer A Parness Company Cpa

Cares Act Loan Faqs For Nonprofits Foundations And Small Businesses Nilan Johnson Lewis Pa Nilan Johnson Lewis Pa

5 Eidl Loan Terms And Requirements You Should Know The Blueprint

5 Eidl Loan Terms And Requirements You Should Know The Blueprint

Covid 19 News Resources Small Business Development Center

Eidl Loan Terms Explained Good Summary Eidl

Sba Economic Injury Disaster Loans Are Still Available Br Startup Junkie

5 Urgent Financial Strategies For Small Business Owners Right Now

Sba Eidl Loan Vs Sba Paycheck Protection Program Tmc Financing