There are a few select suburban areas that meet the USDA criteria. To be eligible for a USDA loan your property must meet certain requirements.

Usda Mortgage Insurance Premium Mortgage Loans Usda Loan Usda

Each fiscal year the Agency targets a portion of its direct and guaranteed farm ownership FO and operating loan OL funds to beginning farmers and ranchers.

Usda loan requirements. However this is the minimum credit score required for an automated approval. Compare loans safely easily. Only one credit check is taken apply today.

USDA loan requirements USDA eligibility is based on the buyer and the property. Annons Loan without security. Receive a non-binding offer and sign with BankId.

USDA Property Location Eligibility. USDA through the Farm Service Agency provides direct and guaranteed loans to beginning farmers and ranchers who are unable to obtain financing from commercial credit sources. Structures can be detached attached Condos PUDs Modular or Manufactured.

It is in a rural area which the USDA defines as having a population under 35000. These include property eligibility based upon the location of the home as well as certain property types and appraisal and inspection requirements. USDA Loan does not have any specific credit requirements in order to use the 21 temporary buydown.

Compare loans safely easily. What Are USDA Loan Requirements. If your credit score is below a 620 but you have sufficient compensating factors you may still be able to get a USDA loan.

Receive a non-binding offer and sign with BankId. To learn more about USDA home loan programs and how to apply for a USDA loan click on one of the USDA Loan program links above and then select the Loan Program Basics link for the selected program. Under USDA direct loan program the homebuyer must meet the following criteria.

You need to meet certain criteria to be considered for a USDA construction loan or a USDA loan to buy a home. First the home must be in a qualified rural area which USDA typically defines as a population of less than. If you wish to purchase a home with a USDA loan there are property requirements that must be met in order for the home to qualify for financing.

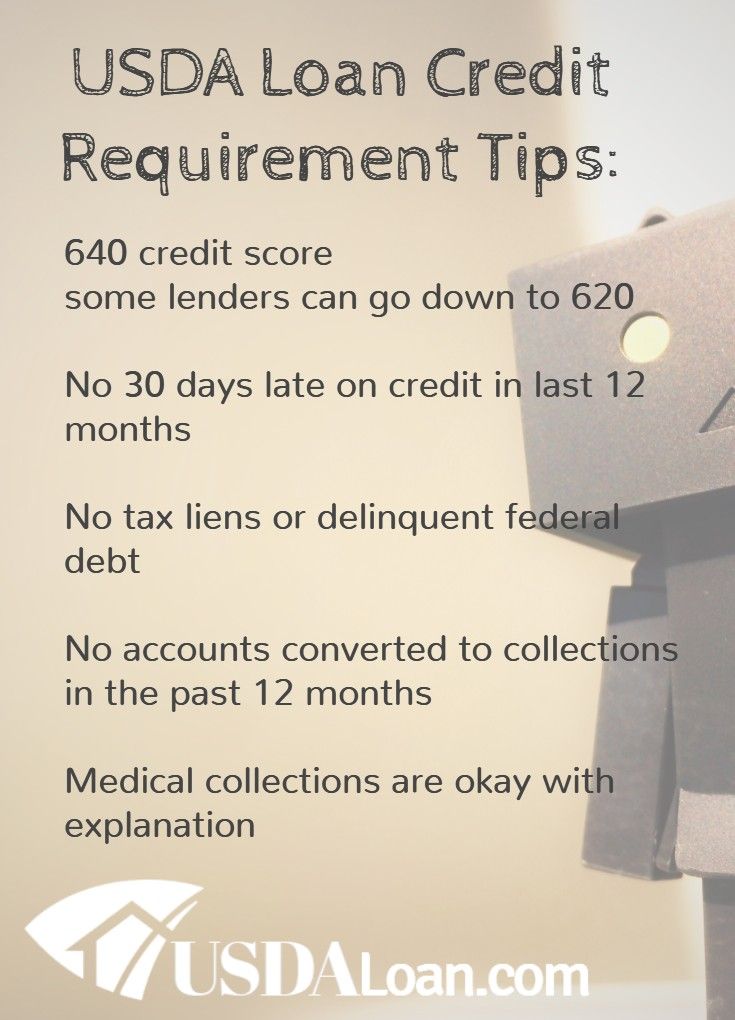

New or existing residential property to be used as a permanent residence. Department of Agriculture and issued by private lendersThey require a 640 credit score and provide 100 financing so no down payment is required. The minimum credit score needed to get a USDA loan is 640 prior to 2017 this was 620.

For the most part the low-income limits are as follows. At a minimum USDA guidelines require. Find the best offer for your car loan today.

The property to be financed should be located in one of the USDA designated rural areas. Annons Over 250000 satisfied customers. USDA loans are guaranteed by the US.

Also the home to be purchased must be located in an eligible rural area as defined by USDA. Annons Loan without security. Stable and dependable income.

Find the best offer for your car loan today. Income-producing properties and vacation homes do not qualify. If you have confusions you can take help from the Federal Home Loan Centres Counsellors to.

It must be your primary residence. Receive a non-binding offer and sign with BankId. Cannot be an income-producing property.

However borrowers must demonstrate compensating factors to Rural Development in order to be eligible for the 21 temporary buydown option as defined in Rural Development Instruction 1980345c5 Determining regular payment amounts. USDA Section 502 Guaranteed Loan funds may be used for. To qualify for a USDA loan the requirements are as follows.

In order to be eligible for many USDA loans household income must meet certain guidelines. USDA Loan Credit Requirements. Only one credit check is taken apply today.

Minimum Qualifications for USDA Loans. For example you must live in the home and it must be your primary residence. Receive a non-binding offer and sign with BankId.

Annons Over 250000 satisfied customers. To be eligible you must be buying a home in a USDA-eligible location and have a total household income that does not exceed 115 of the area median income AMI. Citizenship or legal permanent resident ie.

Non-citizen national or qualified alien Ability to prove creditworthiness typically with a credit score of at least 640. The applicants must have an adjusted income that is at or below the applicable low-income limit.

A Href Https Www Mortgagecalculator Org Helpful Advice Types Of Mortgages Php Epik Dj0yjnu9afdmztrplu14atn2vwhfu In 2021 Understanding Mortgages Usda Loan Mortgage

Fha Loans Vs Usda Loans Infographic Receive Your Free Report Your Usda Blueprint For Success Http Www Usdaloa Usda Loan Home Improvement Loans Fha Loans

Kentucky Rural Housing Development Mortgage Guide For 2021 Usda Loans Kentucky Usda Mortgage Lender For Rural Housing Loans In 2021 Usda Loan Mortgage Kentucky

Understanding Down Payments Home Loans Loan First Home Buyer

Usda Better Program Vs Fha First Time Home Buyers First Home Buyer Home Buying Process

Acceptable Income And Job History For A Mortgage Loan Approval In Kentucky Real Estate Infographic Buying First Home Real Estate Quotes

Usda Loans Info Usda Loan Usda Home Buying Checklist

Kentucky Usda Rural Housing Loans List Of Government Foreclosure Homes For Sale By First Time Home Buyers Buying First Home Home Renovation Loan

Kentucky Rural Housing Usda Loans Usda Loan Conventional Loan Fha

Kentucky Usda Rural Development Loans Rural Development Loan Rural Kentucky

What Is A Usda Loan Eligibility Rates Advantages For 2018 Usda Loan Usda Loan Requirements Loan

What Are The Kentucky Fha Credit Score Requirements For 2020 Mortgage Loan Approvals Kentucky Fha Mortgage Loans Guidelines Fha Loans Mortgage Loans Fha

Kentucky Fha Loan Requirements For 2021 In 2021 Fha Loans Fha Mortgage Loan

Pin On Usda Home Loan Education

Tumblr Usda Loan Home Loans Usda

How To Qualify For A Usda Home Loan Home Loans Best Homeowners Insurance Mortgage Marketing

Understanding Mortgages Understanding Mortgages Usda Loan Mortgage

Down Payment And Credit Score Requirements For A Kentucky Fha Va Conventional Khc And Usda Mortgage Loans