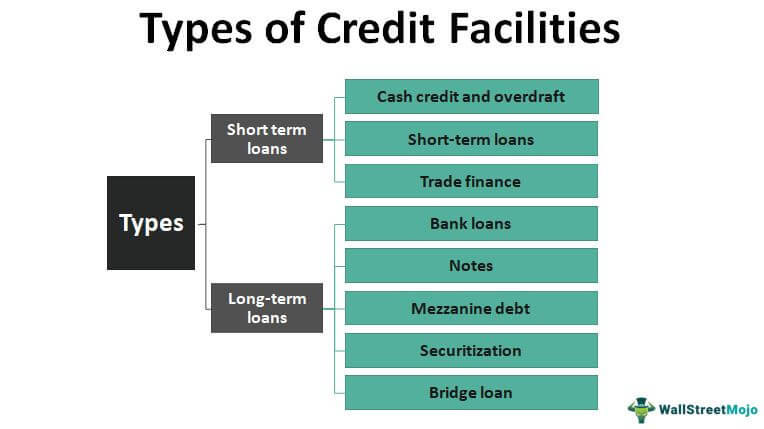

Bridge loans are used in venture capital and other corporate finance for several purposes. A bridge loan is a type of short-term loan which is used by an individual or company as they secure permanent financing or deal with an existing obligation.

A bridge loan is a short-term debt that covers the time period between the conclusion of a prior loan and the commencement of another loan.

Bridge loan definition. Men ffnen Men schlieen. What Is A Bridge Loan. This option is commonly used when an entity is seeking to replace a.

Means any loan that a is unsecured and incurred in connection with a merger acquisition consolidation or sale of all or substantially all of the assets of a person or similar transaction and b by its terms is required to be repaid within one 1 year of the incurrence thereof with proceeds from additional borrowings or other refinancings. Because a bridge. Bridge loans exist to meet immediate cash flow needs during the time between a demand for cash and its availability.

It allows the user to meet current obligations by providing. What is a bridge loan. Bridge loan definition April 09 2021 Steven Bragg.

Here we discuss how a bridge loan works for individuals and corporates along with practical examples. A bridging loan is a type of short term property backed finance. A bridging loan or bridge loan can be useful if you need to borrow money for a short period.

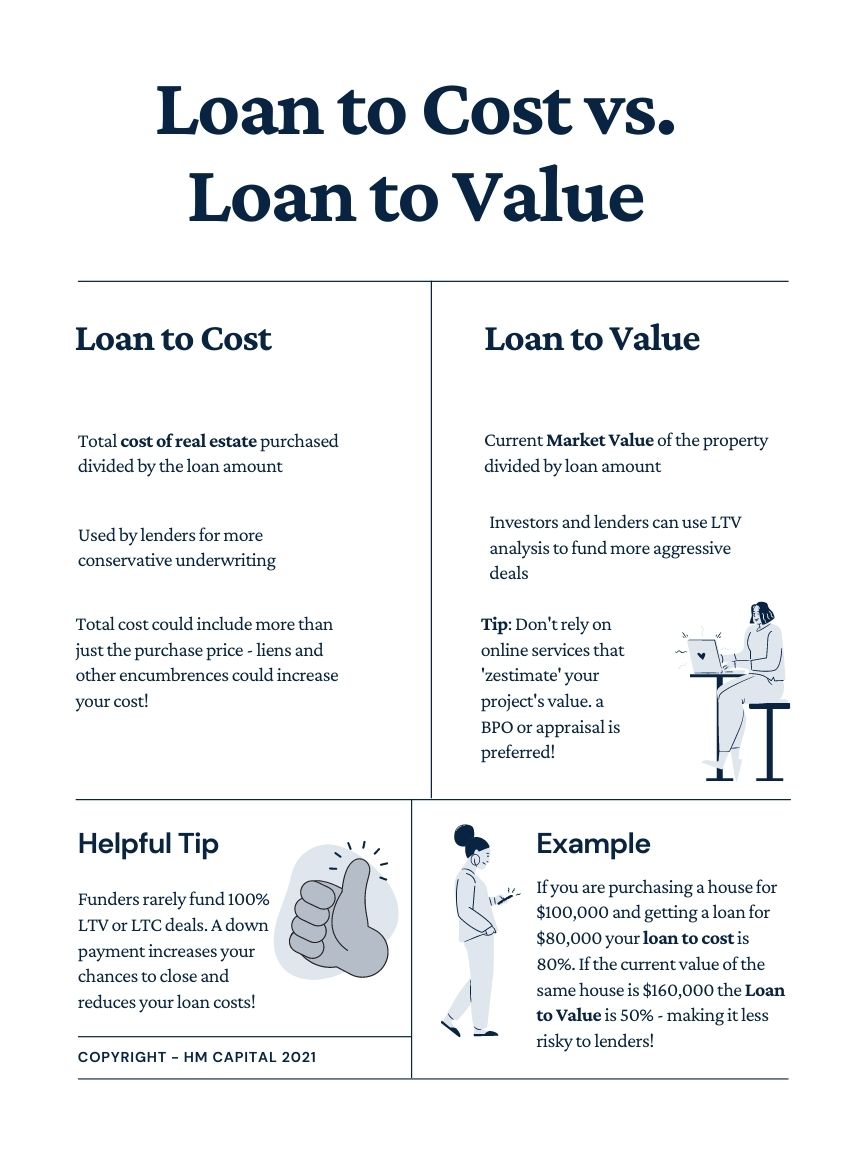

Since lenders have less time to make money on a bridge loan because of their shorter terms they. Bridge loan is a short-term financing facility provided by the financial institutions to the individuals or the company in case of immediate cash requirement before a long-term or regular loan is approved by the bank. A bridge loan also called a swing loan or gap financing is a short-term loan used to buy assets or covers obligations until longer-term financing is found.

Bridge loan is a type of gap financing arrangement wherein the borrower can get access to short-term loans for meeting short-term liquidity requirements. It can help to bridge the gap if you want to buy a new home before selling your old one. Bridge loans help in bridging the gap between short-term cash requirements and long-term loans.

You can learn more about Corporate Finance from the following articles Loan. A bridge loan is typically more expensive than a home equity loan. To carry distressed companies while searching for an acquirer or larger investor in.

It provides immediate cash flow to allow short term obligations to be met. Thus the recipient is committing to obtain longer-term financing shortly that will pay off the bridge loan. Related words and phrases.

These loans have high interest rates and usually go up to one year since they are short. Handling two mortgages at once plus the bridge loan can be stressful. brd lon US bridge loan an arrangement by which a bank lends a person some money for a short time until that person can get the money from somewhere else often so that they can buy another house before they sell their own SMART Vocabulary.

To inject small amounts of cash to carry a company so that it does not run out of cash between successive major private. They are often used to fund you for a period of time whilst allowing you to either refinance to longer term debt or sell a property. A bridge loan is a short-term loan used until a person or company secures permanent financing or removes an existing obligation.

Bridge loans can help borrowers move from one home to the next but they can be dangerous. This has been a guide to what is Bridge Loan and its definition. Origination fees for bridge loans can be high.

What Is a Bridge Loan. You must be able to qualify to own two homes. Cons of bridge loans High interest rates.

While this short-term loan is commonly used in business while waiting for long-term financing consumers. A bridge loan usually runs for six-month terms and is secured by the borrowers old home. What is a Bridge Loan.

The rate of interest on bridge loans is higher as compared to the term loan. Lenders typically charge fees to originate a loan. Bridging loans can also be used if you buy a property at auction where youll need the money immediately but may not have sold your current property yet.

Http Www Lendinguniverse Com Hard Money Loan Htm Illinois Investor Loan Http Www Youtube Com Watch V R Money Lender Hard Money Lenders Construction Loans

How A Bridge Loan Can Help You Buy Your Next House Nerdwallet

What Is A Bridging Loan Money Co Uk

Mixed Use Loans The Ultimate Guide On Financing A Mixed Use Building

What Is A Bridge Loan Rocket Mortgage

Types Of Credit Facilities Short Term And Long Term

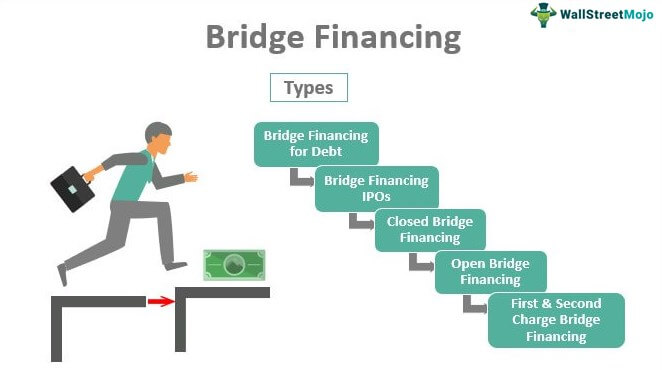

Bridge Financing Meaning Examples How Does It Work

Bridge Financing Overview How It Works Example

What Is A Bridge Loan How Do Bridge Loans Work Youtube

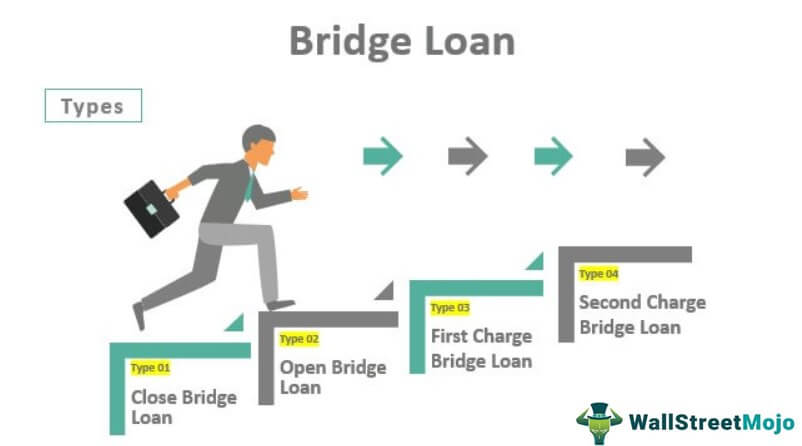

Bridge Loan Definition Examples How Does A Bridge Loan Work

Bridge Loan Definition Bankrate Com

Bridge Loan Bridge Loan Money Management Advice Accounting And Finance

Bridge Loans And Home Purchase Bridge Loans The Truth About Mortgage

Types Of Personal Loans These Are The Options You Have Finance Investing Personal Loans Learn Accounting

What Is A Bridge Loan What Is It For Market Business News

Bridging Loans How Bridging Loans Work Mortgage Choice

/148168412-5c649cdb46e0fb000184a4ff.jpg)