Spent the loan proceeds on payroll costs and other eligible expenses. PPP loans can cover anywhere from eight to 24-weeks.

Ppp Loan Forgiveness Application Step By Step Guide To Get 100 Ppp Loan Forgiveness Youtube

And Spent at least 60 of the proceeds on payroll costs.

Ppp loan deadline. The Paycheck Protection Program PPP ended on May 31 2021. Applications for the final round of. First Draw PPP loans made to eligible borrowers qualify for full loan forgiveness if during the 8- to 24-week covered period following loan disbursement.

The PPP is being extended. The PPP Extension Act of 2021 is a new piece of legislation passed by Congress and signed into law by President Biden that extended the deadline for PPP loan applications from March 31 2021 to May 31 2021. The earliest PPP loans were issued on April 3 2020.

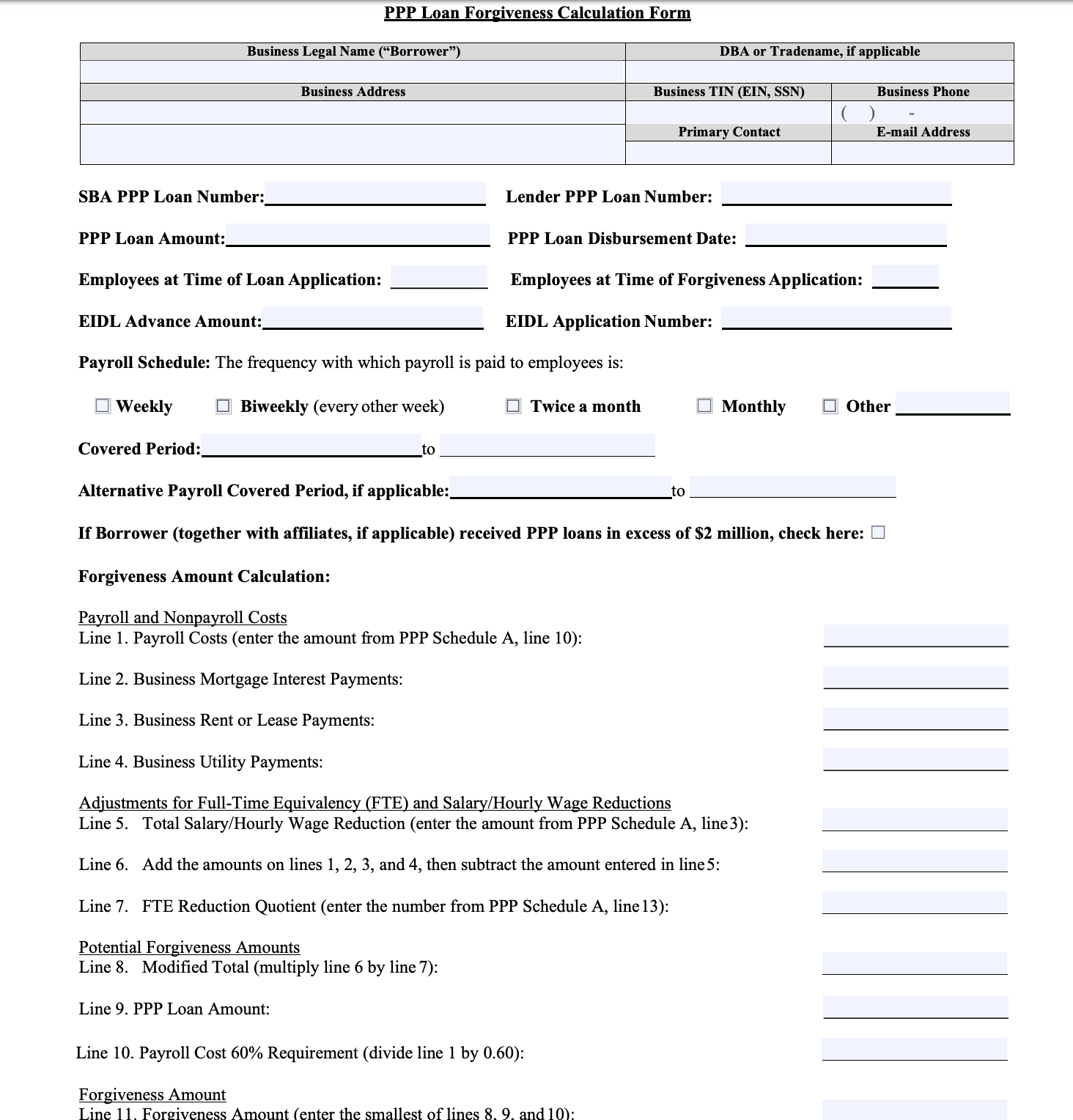

Following its PPP loan disbursement is Sunday April 26 the first day of the Alternative Payroll Covered Period is April 26 and the last day of the Alternative Payroll Covered Period is Saturday October 10. At least 60 of the proceeds are spent on payroll costs. They previously received a First Draw PPP loan.

No new PPP loans will be accepted by SBA after June 1 2021. This means that lenders will keep on accepting applications as long as borrowers still have outstanding PPP loans. First Draw PPP Loan forgiveness terms.

However it is recommended that a business applies for forgiveness before making the first PPP loan payment. For PPP loans made prior to June 5 small businesses will see a loan term of two years as opposed to five years for loans approved after June 5 2020. For example the deadline for a practice that received a loan payment in April 2020 may be at the end of July.

Existing borrowers may be eligible for PPP loan forgiveness. The deadline of May 31 2021 is the same for both applications. If a borrower received its PPP loan funds on that date and chose the 24-week covered period the borrowers first payment on the loan is due on or about July 17 2021.

Deadlines are assigned based on when the practice initially received the funds. The deadlines for dental practices that received Paycheck Protection Program PPP loans to apply for loan forgiveness range from July to September 2021. New PPP loan application deadline of June 30 2021.

If a borrower received its PPP loan funds on that date and chose the 24-week covered period the borrowers first payment on the loan is. Existing borrowers may be eligible for PPP loan. An SBA-backed loan that helps businesses keep their workforce employed during the COVID-19 crisis.

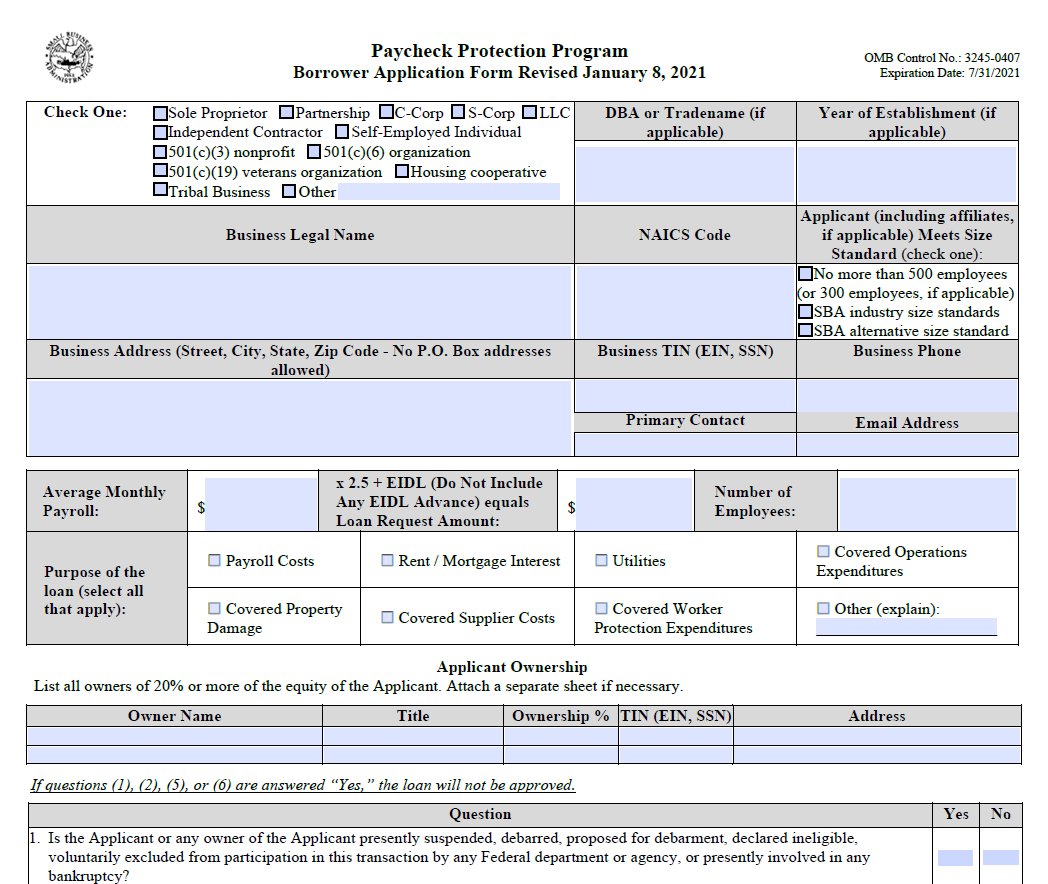

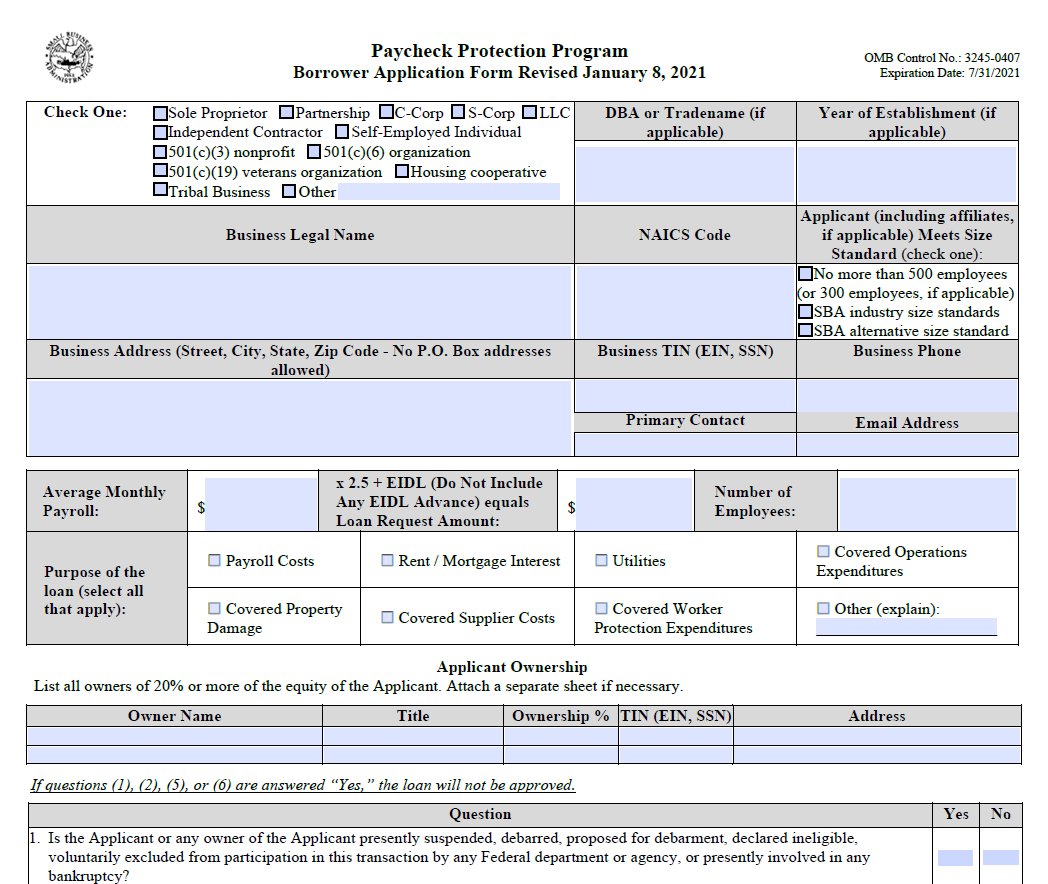

Please click for more details about PPP loans. The biggest difference between the First Draw and Second Draw PPP option is the eligibility and some of the terms. The list of documentation required to apply for PPP Loan forgiveness may vary based on the type of business you have.

However the SBA may not accept new lender applications for first draw or second draw ppp loans submitted after May 31. March 30 2021. Congress has approved an extension of the PPP loan program until May 31 2021 including second draw PPP loans for businesses that received PPP funding in 2020.

So for businesses that received their PPP loan when the program launched in April 2020 there was an eight-week covered period which would put that deadline in the middle of July 2021. It should be noted that Monday May 31 is. What documentation do small businesses need to apply for PPP loan forgiveness.

In no event may the Alternative Payroll Covered Period extend beyond December 31 2020. IMPORTANT UPDATE FOR 2021. The earliest PPP loans were issued on April 3 2020.

PPP loan forgiveness applications have no deadline. May 25 2021 11 AM PT Time is running out for small-business owners looking to get a government Paycheck Protection Program loan. The loan proceeds are spent on payroll costs and other eligible expenses.

The program now officially runs through June 30 2021. PPP ended May 31 2021 The Paycheck Protection Program PPP ended on May 31 2021. Big news for small businesses independent contractors sole proprietors and self-employed individuals looking for PPP loans.

The Paycheck Protection Program PPP loan application deadline has been extended. Businesses are eligible for a Second Draw loan if. New application deadline is May 31 2021.

For most loans operating under the more popular 24-week covered period that could mean a deadline as early as September 2021.

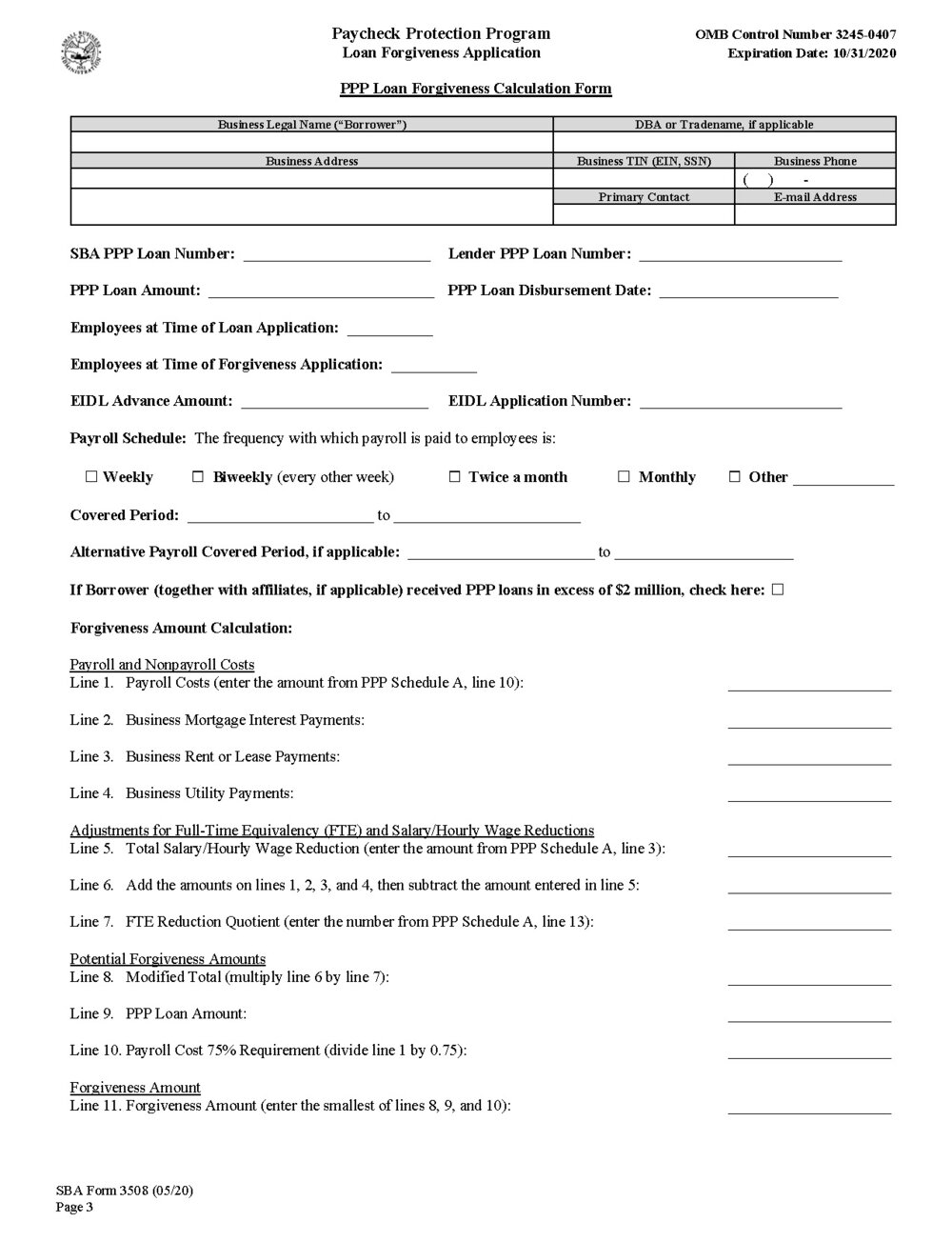

Ppp Loan Forgiveness Process Part 3 How To Complete The Sba 3508 Loan Forgiveness Application The Final Piece Anchor Business Brokers

Sba Hawaii District Office Paycheck Protection Program Ppp Updates

Ppp Small Business Loan Application Sba Downloadable Coronavirus Relief Form Cpa Practice Advisor

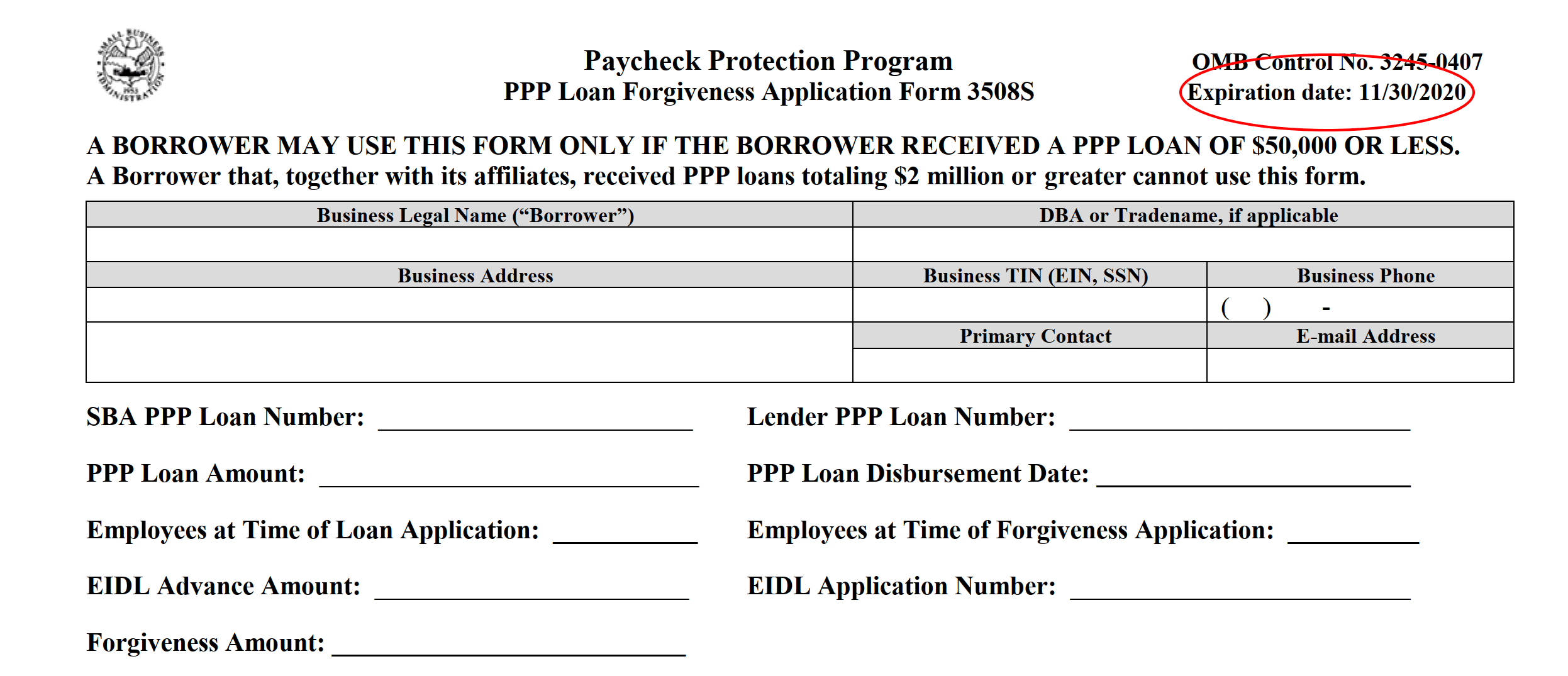

New Sba And Treasury Release Paycheck Protection Program Loan Forgiveness Application

Paycheck Protection Program Ppp Application Form And Information Sheet For Borrowers Kuiken Brothers

How To Apply For A Ppp Loan Updated For 2021 Finder Com

How To Fill Out Your Ppp Forgiveness Application Form Simplifi Payroll And Hr

For Ppp Loans Small Business Owners Should Stop And Think Before Seeking Forgiveness

Ppp Loan Forgiveness Everything You Need To Know Bnc Tax

Sba Paycheck Protection Program Anvil

Ppp Round 2 Everything You Need To Know Capforge

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

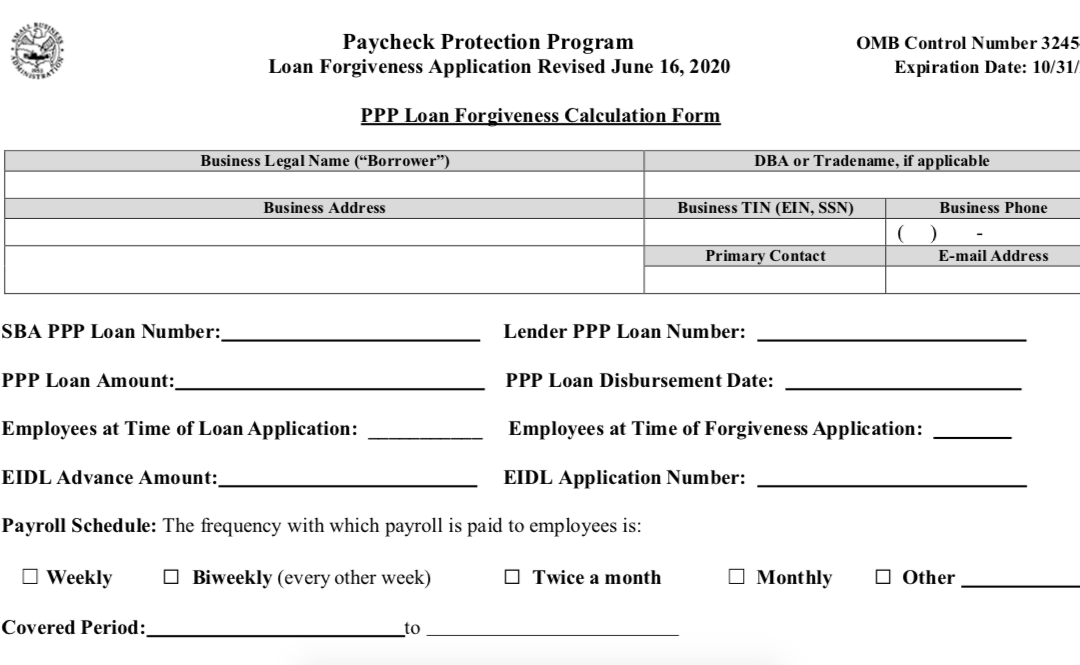

Ppp Loan Forgiveness Application Updated 6 16 2020 C Brian Streig Cpa

New Ppp Loan Forgiveness Application Turns Ppp Loan Into Grant Wowk 13 News

Sba Clarifies Filing Date S For Ppp Loan Forgiveness Gyf

Ppp Loan Forgiveness Application Should You Wait To Apply

Calling All Businesses Nonprofits Apply For The Ppp Loan Before June 30 Deadline

New Guidance For Ppp Loan Eligibility Safe Harbor Deadline Extended To May 14 Yeo And Yeo