To learn more about USDA home loan programs and how to apply for a USDA loan click on one of the USDA Loan program links above and then select the Loan Program Basics link for the selected program. The USDA loans goal is to provide safe and sanitary residences for low to moderate-income households.

Acceptable Income And Job History For A Mortgage Loan Approval In Kentucky Real Estate Infographic Buying First Home Real Estate Quotes

However borrowers must demonstrate compensating factors to Rural Development in order to be eligible for the 21 temporary buydown option as defined in Rural Development Instruction 1980345c5 Determining regular payment amounts.

Usda home loan requirements. USDA loan requirements. USDA loans are available for people who wish to use the property as primary residence. The Section 502 Guaranteed Loan Program assists approved lenders in providing low- and moderate-income households the opportunity to own adequate modest decent safe and sanitary dwellings as their primary residence in eligible rural areas.

For example you must live in the home and it must be your primary residence. USDA Loan does not have any specific credit requirements in order to use the 21 temporary buydown. Multi-Family Housing Loan Guarantees.

USDA Loan Property Requirements. USDA loans are guaranteed by the US. We already know that the property must be rural in nature but the program does have further requirements.

Through the USDA loan eligible homebuyers can purchase build or refinance a home. No financing is available. Also the home to be purchased must be located in an eligible rural area as defined by USDA.

USDA eligibility is based on the buyer and the property. The programs also make funding available to individuals to finance vital improvements necessary to make their homes decent safe and sanitary. The property to be financed should be located in one of the USDA designated rural areas.

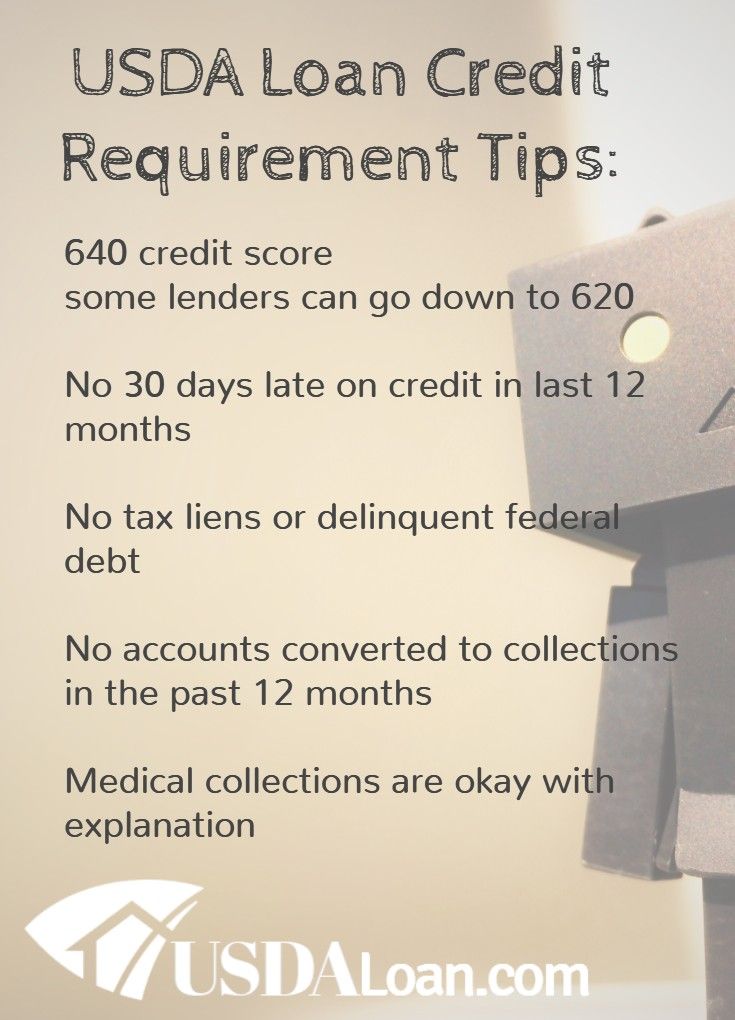

If you have confusions you can. To qualify for a USDA home loan the basic requirements are as follows. If your credit score is below a 620 but you have sufficient compensating factors you may still be able to get a USDA loan.

Department of Agriculture and issued by private lendersThey require a 640 credit score and provide 100 financing so no down payment is required. In order to be eligible for many USDA loans household income must meet certain guidelines. To meet this goal the USDA sets basic property requirements that protect homebuyers as well as lenders.

Customers may submit an electronic comment for any rule currently open for comment. There are some mandatory requirements that must be satisfied for a USDA loan. The site you will place the home on also plays a role in the financing.

First the home must be in a qualified rural area which USDA typically defines as a population of less than. You need to meet certain criteria to be considered for a USDA construction loan or a USDA loan to buy a home. So if you want to buy a home and are looking for the best loan options youve come to the right place.

To be eligible you must be buying a home in a USDA-eligible location and have a total household income that does not exceed 115 of the area median income AMI. The property must be located in an area that is designated as rural by the USDA your FedHome Loan Centers Loan Officer can find out if a property is eligible Program is available for purchase transaction only no. The minimum credit score needed to get a USDA loan is 640 prior to 2017 this was 620.

Both homes must have at least 400 square feet of living area to qualify as well. However this is the minimum credit score required for an automated approval. All foundational structural mechanical water systems heating and cooling as well as potential termitepest issues must be closely inspected.

Eligible applicants may purchase build rehabilitate improve or relocate a dwelling in an eligible rural. USDA Multi-Family Housing Programs offer Rural Rental. USDA provides homeownership opportunities to low- and moderate-income rural Americans through several loan grant and loan guarantee programs.

To qualify for a USDA loan the requirements are as follows. Heres an overview of the other requirements. One of the major requirements for the program that comes up frequently is what type of property can a USDA home loan be used to purchase.

Before the Agency makes a loan the Loan Originator must ensure that the applicant will have an appropriate form of ownership and that the Agencys interest in the property is adequately secured by the value of the real estate and the Agencys lien position. USDA has posted its proposed rules revised rules and final regulations related to the development of rural areas. Any property purchased using a USDA home loan must be purchased for the purpose of primary residency.

To finance an existing home with a USDA loan you must have a state-licensed inspector conduct an inspection of the entire home. Federal OSHA Migrant Housing Regulations. Credit Score A minimum credit score of 640 is required for an automated approval.

Since USDA home loan guidelines are very specific it is important to work with a company that has the right amount of experience dealing with USDA government financing to help determine your eligibility. USDA improves rural community economic health by working with private lenders to guarantee loans to borrowers for the construction of rural multi-family housing units and individual homes. This includes minimum credit scores and other aspects of credit history.

Section 4 specifies Agency security requirements and Section 5 provides guidance on. Single wide homes must be at least 12 feet wide and double wide homes must be at least 20 feet wide.

How To Qualify For A Usda Home Loan Home Loans Best Homeowners Insurance Mortgage Marketing

Understanding Down Payments Home Loans Loan First Home Buyer

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Louisville Kentucky Va H Va Loan Loan Rates Va Mortgage Loans

Usda Loans Info Usda Loan Usda Home Buying Checklist

Different Types Of Kentucky Home Loans Home Mortgage Home Buying Process Home Buying

Understanding Mortgages Understanding Mortgages Usda Loan Mortgage

What Is A Usda Loan Eligibility Rates Advantages For 2018 Usda Loan Usda Loan Requirements Loan

Tumblr Usda Loan Home Loans Usda

Kentucky Rural Housing Development Mortgage Guide For 2021 Usda Loans Kentucky Usda Mortgage Lender For Rural Housing Loans In 2021 Usda Loan Mortgage Kentucky

A Href Https Www Mortgagecalculator Org Helpful Advice Types Of Mortgages Php Epik Dj0yjnu9afdmztrplu14atn2vwhfu In 2021 Understanding Mortgages Usda Loan Mortgage

Kentucky Usda Rural Housing Loans List Of Government Foreclosure Homes For Sale By First Time Home Buyers Buying First Home Home Renovation Loan

Complete List Of Mortgage Application Documents Hsh Com Refinance Mortgage Mortgage Loans Mortgage Tips

Usda Better Program Vs Fha First Time Home Buyers First Home Buyer Home Buying Process

What Are The Kentucky Fha Credit Score Requirements For 2020 Mortgage Loan Approvals Kentucky Fha Mortgage Loans Guidelines Fha Loans Mortgage Loans Fha

Kentucky First Time Home Buyer Mortgage Loans Down Payment And Credit Score Requirements For A Kentucky Fh Mortgage Loans First Time Home Buyers Home Mortgage

Usda Mortgage Insurance Premium Mortgage Loans Usda Loan Usda

Kentucky Rural Housing Usda Loans Usda Loan Conventional Loan Fha